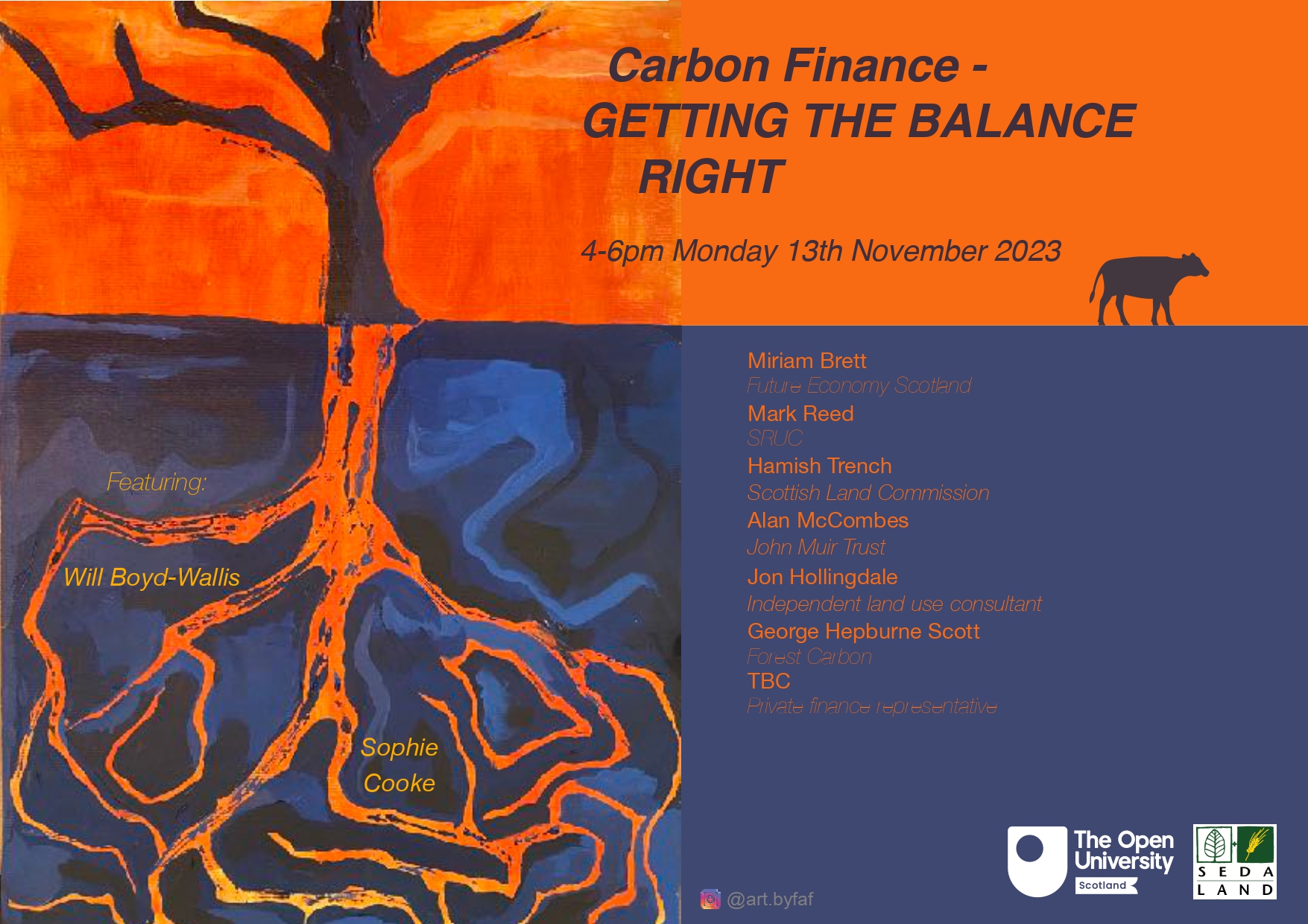

SEDA Land Carbon Finance 2: Getting the Balance Right

Online

Nature markets are here to stay, whether we like it or not. Contrary to much current opinion, such markets, which include carbon markets, biodiversity markets, and other emerging ecosystem markets, don’t have to be negative. With the right checks and balances they can open up opportunities for communities who may feel threatened by them. This is something SEDA Land will be exploring in two events: Carbon Finance – COMMUNITY BENEFITS and GETTING THE BALANCE RIGHT.

This, the second conversation: 'Carbon Finance – Getting the Balance Right’, will address the different types of investment in nature-based solutions to climate change – private, public and hybrid – as well as taxation, such as the John Muir Trust’s proposed Carbon Emissions Land Tax. Professor Mark Reed, SRUC, who is advising national governments and the United Nations on the development of high-integrity ecosystem markets, whilst advocating for stronger community engagement and benefit in his role with the Just Transition Commission, will outline the current state of legislation and what we still might influence.

There are growing concerns about the impact of private investment on land prices, tenant farmers and local communities, and the potential for greenwashing. Some, including Lorna Slater, minister for the circular economy and biodiversity in the Scottish Government, argue that the scale and speed of change needed to meet net zero targets in the land sector necessitates private investment. Others argue that private investment is only necessary because of government’s failure to prioritise climate action, and that the focus should be on progressive taxation to fund nature-based solutions.

Some of the themes that are going to be discussed include:

- Who are the greatest winners and losers likely to be, and how might those with least power shape and benefit from these markets, as part of a just transition to net zero?

- If there is to be a role for private finance in this transition, how can high-integrity markets and regulation be designed to protect tenants, communities and the public interest?

- Should rural communities be actively engaging in these markets, passively sharing profits from local schemes, or would they be better off without these markets at all?

- Could a carbon emissions land tax fill the gap in public finances that markets are trying to plug?

- Might a combination of new taxes and new markets be the only way to reach the tree planting and peatland restoration targets recommended by the UK Committee on Climate Change?